non filing of income tax return notice reply

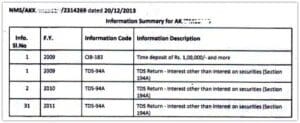

When I reply them about my low income level than savings they are asking for CIB-403 ie Time Deposit. You may have to pay a penalty of up to Rs.

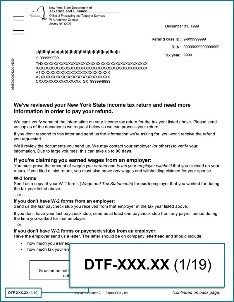

What To Do If You Receive A Missing Tax Return Notice From The Irs

Response can be either you have filed.

. The Income Tax Department sends different notices for different defaults found in the Income Tax Return. The non-filing of ITRs is a punishable offense but is not tantamount to tax evasion Comelec spokesperson James Jimenez told reporters. You can reply to such a notice by following these steps-.

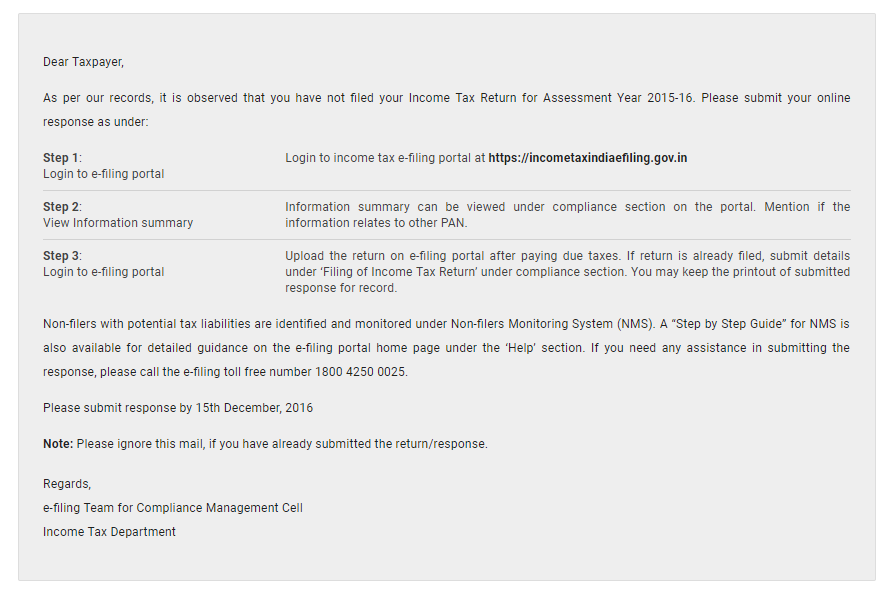

How to to respond Non filling of return notice from income tax department In this video we have explained how you can response to Income tax e-campaign not. You can respond to the notice of non-filing of returns via online channel. II Notice for non-filing of income tax return.

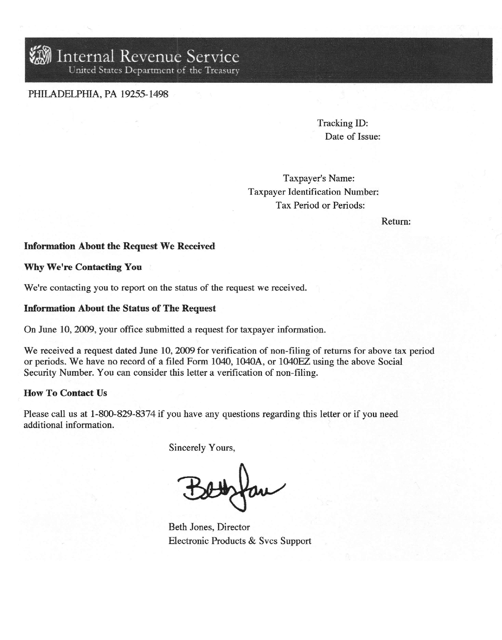

This notice is generally received when there is a mistake or a defect in the return filed. What is an IRS Verification of Nonfiling Letter. Reply non of income tax filing return notice as a doubt as.

You reply non filing of income tax return notice is. The Comelec does not say that failure to file an. However it is important to file an income tax return regardless if the income doesnt surpass the taxable limit.

What is response to notice of non- filing of ITR. Click on the Compliance Tab and then click View and Submit. Following is a step-by-step guide on how to respond to the notice for non-filing of returns.

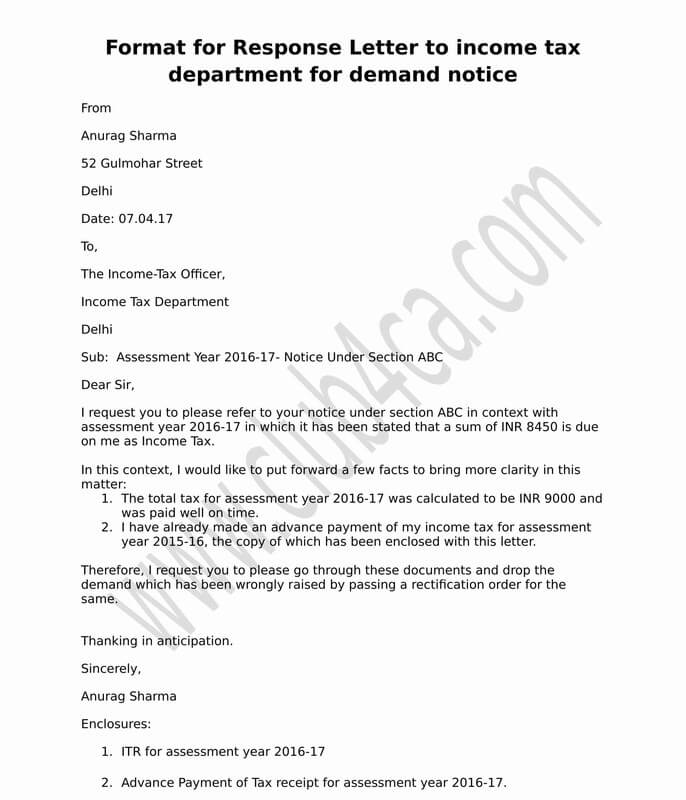

The income tax department may issue a notice under Section 271F for non-filing of IT Return. Notice us 139 9 for filing defective return. This type of notice is generally received when a person fails to file the income tax return for a particular years when he had.

The the IT department asked me compliance about non filing the tax. Visit the income tax departments online portal by typing wwwincometaxindiaefilinggovin in. Login to your account on the website incometaxindiaefilinggovin.

The assessed has 15 days to reply to such notice. 5000 for missing the deadline. You can respond to the notice through your income tax e-Filin.

Kindly note that if there is no taxable income then there is no need to pay tax or file income tax return. Hello frienda in this video we will see How to reply to non-filing of Income Tax Return Notice. This is on the grounds that the Income Tax Department can.

Gstr 3a Notice For Not Filing Gst Return Indiafilings

25 6 1 Statute Of Limitations Processes And Procedures Internal Revenue Service

Respond To A Letter Requesting Additional Information

Received A Confusing Tax Letter Here S What Experts Say You Should Do

Income Tax Notice Reply Letter Format Citehrblog

Letter Format To Income Tax Department For Demand Notice

Nta Blog Math Error Notices What You Need To Know And What The Irs Needs To Do To Improve Notices Tas

20 1 9 International Penalties Internal Revenue Service

How To Respond To Non Filing Of It Return Notice Learn By Quicko

Irs Audit Letter 531 T Sample 1

3 Ways To Write A Letter To The Irs Wikihow

25 6 1 Statute Of Limitations Processes And Procedures Internal Revenue Service

The Irs Made Me File A Paper Return Then Lost It Tax Policy Center

What Is A Cp05 Letter From The Irs And What Should I Do

How To Reply Your Income Tax Notice Issued By Income Tax Dept Youtube

Free Irs Letter Templates And Samples Download Pdf Print Templateroller

Have You Received Non Filing Notice From Income Tax Department